Interest Rates in 2009: A Year of Dramatic Shifts

2009: The lingering effects of the 2008 financial crisis cast a long shadow, and at the heart of the economic turmoil lay interest rates. These weren't mere numbers; they were the lifeblood of the global economy, profoundly impacting everything from home prices to corporate health. This article delves into the dramatic fluctuations of 2009's interest rates, explaining the complexities with clarity. We will explore the connection between the Federal Reserve's actions, the housing market's downturn, and the overall economic landscape. For more on home equity loan rates, see this resource.

The Calm Before the Storm: Interest Rates Before 2009

Before the crisis exploded, the years leading up to 2009 were marked by comparatively low interest rates. This period of readily available credit fueled economic expansion and a booming housing market. However, this prosperity masked a dangerous undercurrent: a massive build-up of risky mortgages—loans given to borrowers who likely couldn’t afford them. This created a ticking time bomb that would ultimately shatter the illusion of stability. Were the low interest rates a catalyst for the impending crisis? Subsequent analysis suggests a strong correlation.

This environment of low rates encouraged borrowing across the board, fueling economic growth but also creating an unhealthy dependence on debt. The housing market, in particular, experienced an unsustainable boom, with property values spiraling upwards to unrealistic levels. This unsustainable growth, fueled by easy credit, laid the groundwork for the devastating events to come.

The Lehman Brothers Collapse and Its Fallout

The collapse of Lehman Brothers in September 2008 triggered a global financial crisis. Fear seized markets as lenders, fearing further losses, drastically restricted credit. This credit crunch had a devastating ripple effect, severely impacting businesses and individuals alike. Did the Lehman Brothers collapse become the tipping point that toppled the already unstable economic structure? Many economists believe it was the final straw.

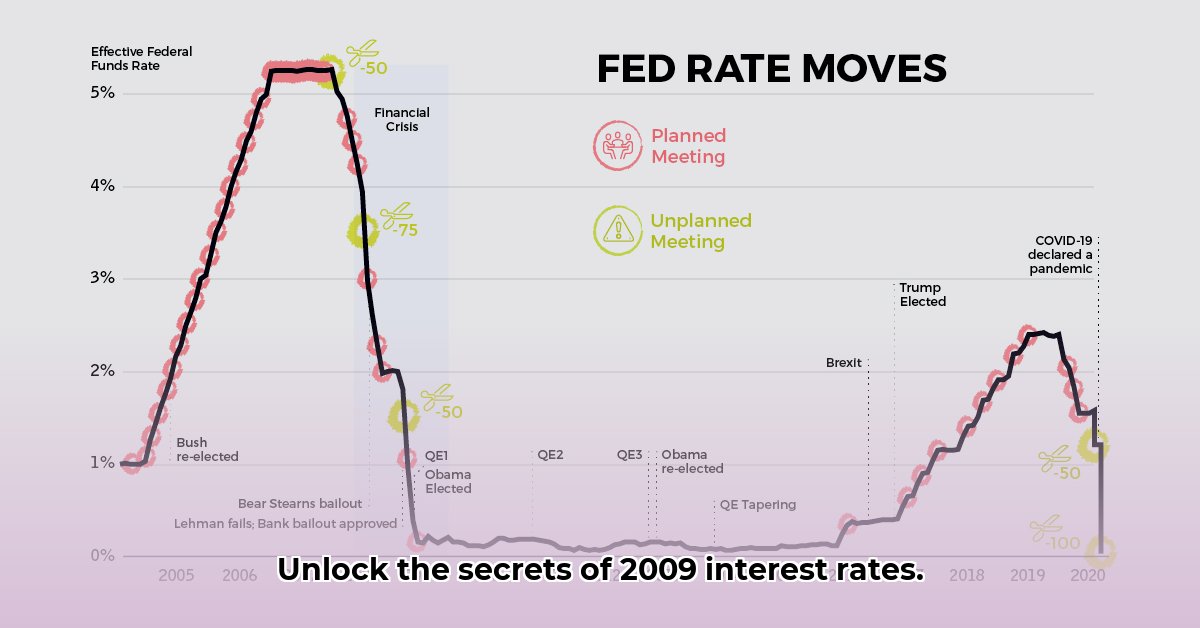

Faced with a potential economic meltdown, the Federal Reserve (the Fed) responded with aggressive action, slashing its key interest rate—the federal funds rate—to near zero. This drastic measure aimed to stimulate borrowing and spending, hoping to jumpstart the economy. This marked the start of an unprecedented period of near-zero interest rates.

Interest Rates in 2009: A Year Near Zero

2009 witnessed exceptionally low interest rates. The Fed's near-zero policy had a wide-ranging impact. Mortgage rates plummeted, offering a potential boon to homebuyers. However, did these low rates immediately revive the struggling housing market? The answer is complex: while rates were low, the lingering effects of the crisis, including widespread job losses and economic uncertainty, hindered a quick recovery.

The low rates weren’t a panacea. Businesses, already struggling with decreased demand and tighter credit, remained hesitant to invest. The economy remained fragile, and the low rates, while helpful, weren't enough to overcome the deep-seated issues. The situation felt akin to trying to start a car with a dead battery—a small push wasn't enough to get things moving.

The Impact on Stakeholders: A Multifaceted Analysis

The low interest rates of 2009 affected various stakeholders differently:

Homebuyers: While low mortgage rates could have offered improved affordability, many potential buyers were deterred by job losses and economic uncertainty.

Lenders: Faced significant challenges, dealing with high default rates and struggling to recover losses.

Investors: Traditional investments yielded low returns, pushing many towards riskier options in search of higher yields.

Policymakers: The Fed's actions were a desperate attempt at preventing a complete collapse, a precarious balancing act to stimulate growth without triggering inflation.

The Lingering Shadow: Long-Term Consequences

The persistently low interest rates of 2009 had profound lasting effects. The prolonged period of cheap borrowing contributed to a slow housing market recovery. Some experts argue this period may have had unintended consequences planting the seeds for future economic woes. The events of 2009 offer crucial insights into how interest rate policies influence economic recovery. The long-term repercussions are a complex area of ongoing economic debate.

Key Takeaways:

- The 2008 financial crisis precipitated a dramatic drop in interest rates in 2009.

- The Federal Reserve's near-zero interest rate policy aimed to stimulate the economy but faced challenges.

- The impact on various stakeholders was multifaceted and complex, with both positive and negative consequences.

- The long-term effects of 2009's interest rate environment continue to be debated and analyzed by economists.

How Did the 2008 Financial Crisis Impact Long-Term US Mortgage Rates?

The 2008 financial crisis fundamentally reshaped the US mortgage market. Before the crisis, relatively low interest rates fueled a housing boom, masking the vulnerabilities within the system. Subprime mortgages, often bundled into complex securities, represented hidden risks. The bursting of the housing bubble triggered profound consequences.

The Fallout: A Perfect Storm

The Lehman Brothers collapse marked a critical turning point. Market panic resulted in a credit freeze. The subsequent recession forced the Federal Reserve to aggressively cut interest rates. How did the crisis impact long-term US mortgage rates? The effect was dramatic and volatile.

Initially, rates plummeted, theoretically benefiting homebuyers. Yet, the credit crunch made obtaining a mortgage exceptionally difficult. Lenders became risk-averse, implementing stricter lending criteria that challenged even creditworthy applicants.

2009: Navigating the Aftermath

2009 saw mortgage rates at record lows, but this wasn't a simple positive. The low rates reflected the precarious state of the economy. Weakened demand, coupled with soaring foreclosures, created a complicated scenario for potential buyers: lower rates were offset by the challenges of securing financing. Economic uncertainty dampened the appeal of cheap borrowing.

The Impact on Stakeholders

The 2008 crisis significantly affected various groups:

- Homeowners: faced falling property values and increased foreclosures.

- Lenders: suffered massive losses and adopted stricter lending standards.

- Investors: experienced portfolio losses and decreased market confidence.

- Policymakers: implemented emergency measures and bailouts in a desperate effort to avert a complete financial meltdown.

Long-Term Consequences

The 2008 crisis irrevocably changed the mortgage landscape. New regulations aimed to prevent future crises, leading to stricter lending standards. Access to mortgages tightened, slowing economic recovery. The crisis's legacy continues to shape the mortgage market and economic policy today.

Key Takeaways:

- The 2008 crisis led to historically low mortgage rates.

- Limited mortgage access offset the benefits of low rates.

- The crisis spurred significant regulatory reforms.

- Long-term consequences included a tighter credit market and increased scrutiny of lenders.